Our Investment Philosophy

In today’s rapidly changing world, prudent investing requires a proactive approach towards managing, growing and preserving wealth. Incorporating the perspectives of our Investment Strategy Committee, we seek to anticipate long – term trends in the markets and position client portfolios to be proactive rather than reactionary.

We also believe that managing investor behavior – and taking the emotions out of investing - is a key ingredient to long term success.

Some of the principles that we follow to guide our decisions in all markets:

- Maintaining Objectivity

- Managing Overall Portfolio Risk

- Tax – Smart Investing

- Aligning overall goals with the portfolio

- Managing Portfolio Costs

Our Investment Process

We create your personalized investment strategy – a plan for how your investments will be allocated that is tailored to your goals and is based upon your investment preferences, risk tolerance and your Family Index Number.

We can also do a portfolio stress test on any existing investment holdings you currently hold to ensure that these accounts are in line with your overall goals.

Benefits to You

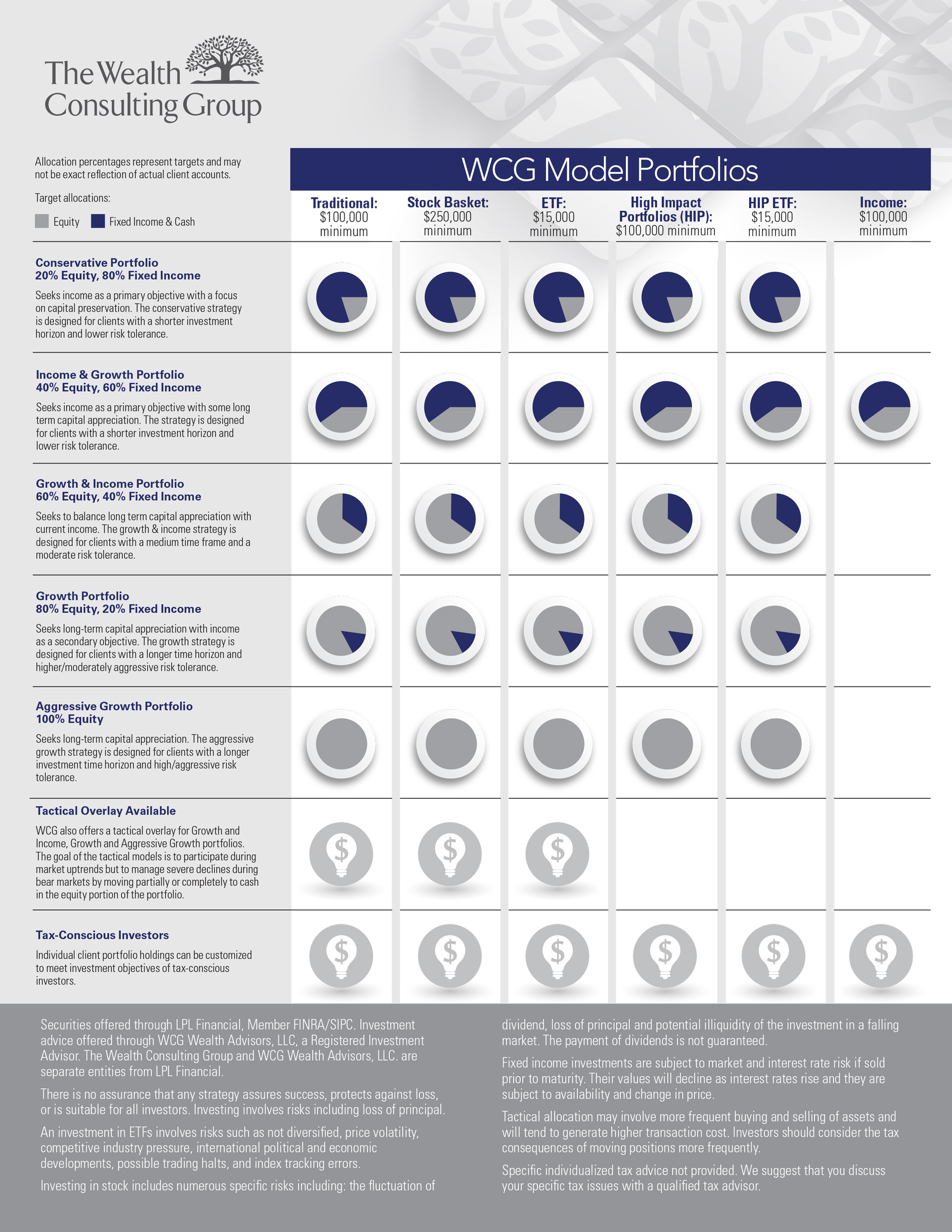

- Model Portfolios created by the WCG Investment Strategy Committee and then tailored to meet your specific investment strategies.

- We assign each investment account a goal and put your money to work for you

- Assets that align with your values (e.g. social values, environmentally responsible, corporate governance practices) allowing you to make a difference with your dollars. (High Impact Portfolios)

- Regular update meetings and portfolio adjustments as your goals and lifestyle change.

- Transparency of Costs: annual management cost is based on the amount of assets under management, not on investment selection or number of trades.

- 24 Hour access to online accounts showing detailed account values, account holdings, activity and performance.

IMPORTANT: The projections or other information generated by Riskalyze regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. These figures may exclude commissions, sales charges or fees which, if included would have had a negative effect on the annual returns. Investing is subject to risk which may involve loss of principal. No strategy assures success or protects against loss. Past performance is no guarantee of future results. Riskalyze Inc. is a member of LPL’s vendor affinity program and is in no way affiliated with LPL Financial.